The bank must do this to protect its customers from potential elder financial exploitation. You’ll need to provide the power of attorney document to the financial institution so it can ensure the document is valid. That means confirming that someone has been named power of attorney or is a court-appointed conservator.Įven if your parents or loved ones have signed a legal document naming you their power of attorney to make financial transactions for them, you can’t expect their bank to take your word for it. So before giving anyone access to a customer’s account, “we want to make sure the necessary legal prerequisites are met,” says Joe Dylla, in-house counsel and vice president of The First National Bank in Sioux Falls.

Why banks require power of attorney documentsīanks, credit unions and other financial institutions take their obligation to protect customers and their privacy seriously. To avoid ending up in a situation like this, it’s important to understand why your parents’ financial institutions might not accept the POA you present and what you can do to increase the chances that they will.

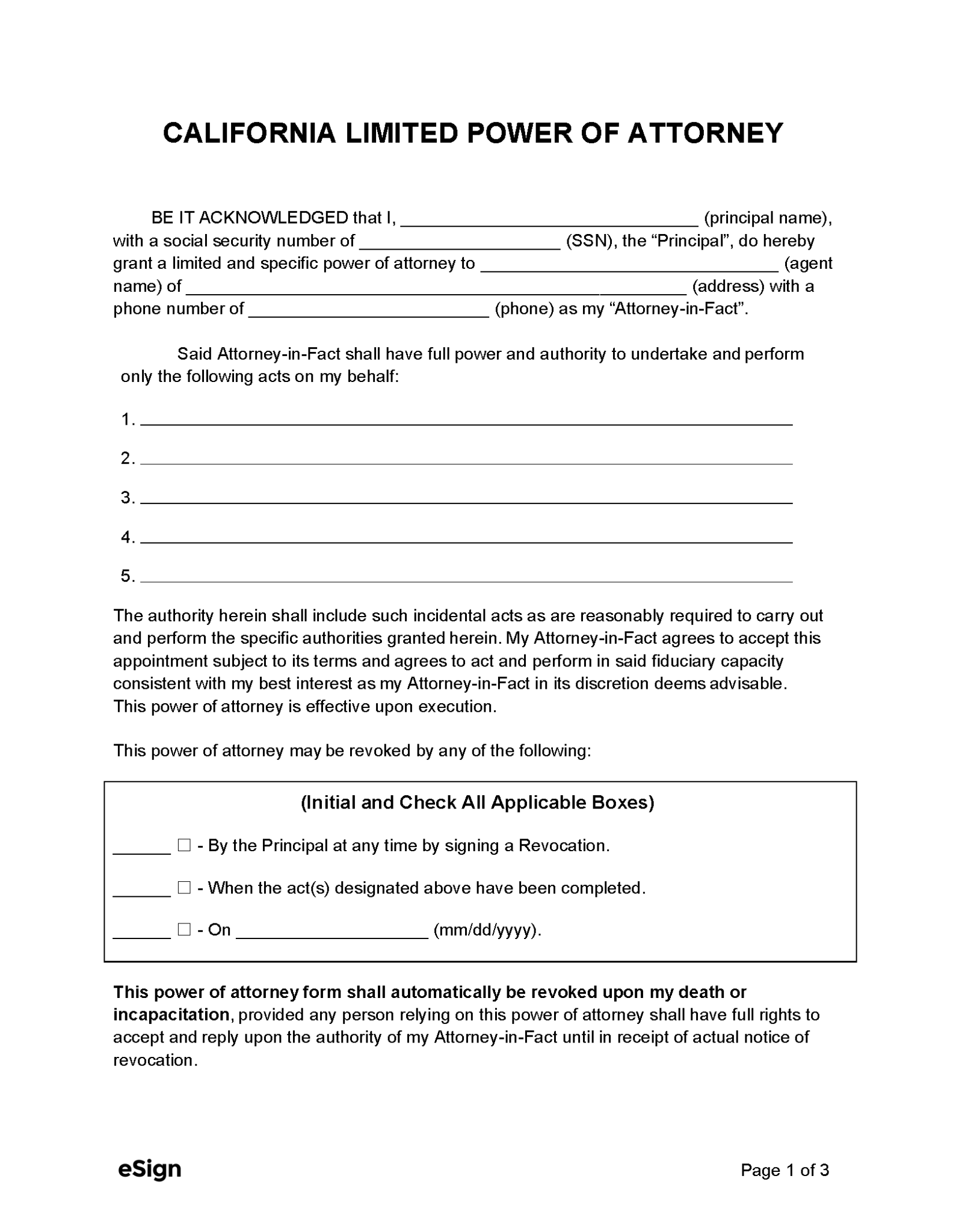

#California durable power of attorney for finances form how to#

Then caregivers are left scrambling to figure out how to help loved ones with daily money matters when they can’t access their accounts. There’s no shortage of stories about banks and financial institutions refusing to honor power of attorney documents. Unfortunately, this could happen to you if you have to help parents or aging loved ones with their finances. So you take the power of attorney document to her bank to prove that you have the legal right to access her account and make transactions for her now that she might have dementia.

So it seems like a good time to take an active role in her finances.įortunately, she has named you her power of attorney. You’re worried that she is forgetting to make bill payments.

Picture this: Your mom is widowed and is starting to have trouble remembering things.

0 kommentar(er)

0 kommentar(er)